The Importance of Developing your Brand

In past year, independent foodservice operators attracted 1.7 billion fewer visits than year to September 2008 as they struggle to be relevant on Britain’s high street.

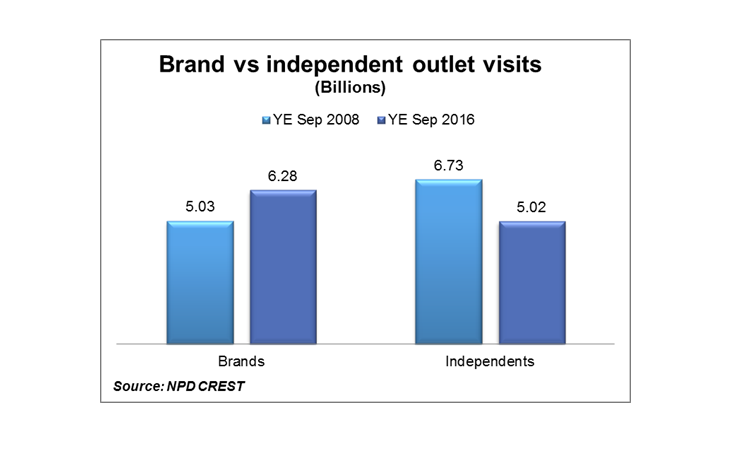

Figures released by global information company The NPD Group show that when we eat away from home, we are more likely to spend our money at branded outlets. Eight years ago (to YE Sept 2008), the market share for brands vs independents in visit terms was 43% vs 57%. As of YE Sept 2016, this has nearly reversed with the brands vs independents share now at 56% vs 44%. That means branded businesses in YE Sept 2016 are enjoying 1.2 billion extra visits in Britain’s £50 billion foodservice industry than eight years before (5.03 billion visits YE Sept 2008; up by + 25% to 6.28 billion by YE Sept 2016). On the same basis, independents saw visits drop from 6.73 billion in YE Sept 2008 to 5.02 billion in YE Sept 2016 (down 1.7 billion).

The poor performance among independents is reflected in sales figures. Since 2008, brands have boosted annual sales from around £20.9 billion to well over £30 billion today, while independents have seen sales dive from £30 billion to £23.2 billion. Brands enjoy strong pricing power, having achieved an increase of 16% in the average bill per person over the past eight years versus 4% for independents.

Brands understand younger customers

What’s driving this change on Britain’s high street? One factor is the success branded foodservice chains are having with young customers. In the pub sector, brands capture 20% of visits among the 25-to-34 age group, way ahead of the 11% figure for independents. In the FSR (full-service) sector, brands win 25% of visits in the same age group, ten percentage points more than independents. Still in FSR, in the lower 18-to-24 age group, brands attract twice as many visits as independents (12% vs 6%).

Brands also win in two other ways – breakfast and meal deals. Brands can attribute 14% of their visits to breakfast trade, a much higher proportion than the 8% seen for independents. Brands drive over 36% of their visits through meal deals or promotions, while independents only succeed in driving around 13% of their traffic through this tactic.

Brands dominate London

Brands get more of their business than independents from London (21% vs 13%), winning hands down in market share inside the capital (68% vs 32%). Drill down into London’s QSR and pub markets and the data shows that brands are even better against independents (80% vs 20%).

Cyril Lavenant, NPD’s Director of Foodservice UK, said: “For the branded sector to have reversed its market share with independents over just eight years underlines how quickly Britain’s foodservice market is changing. Independents are struggling to be relevant and appealing to consumers on the British high street and clearly do not ‘speak’ well to young adults. Foodservice chains do a better job in this respect, especially with meal deals and promotions. Consumers are hungry for good value and they know where to go for it on the high street. Another factor is the ability of bigger brands to invest in their products and to expand into new locations. When the public choose where to eat out – whether it’s simple food-on-the-go, a sit-down snack or sandwich, or a more formal meal – people are clearly voting for brands.”

Independents losing out most in pub sector

The shift from independents to brands is even more drastic in the pub sector. Britain’s branded pubs have increased visits by a massive 65% over the past eight years. Independents have seen business tumble by -48%. It’s a similar story in FSR (excluding cafes & bistros) where brands have grown visits by +39% over the past eight years, while independents have slipped -28%. For the QSR sector, the changes are +22% (brands) and -14% (independents).

Cyril Lavenant added: “Thousands of independent pubs have closed down because they have not followed the market trends for a broad range of good quality food served in a child-friendly environment. Yes, we all know an excellent independent pub or restaurant that does a great job with food but they only make up a small part of the overall independent sector.”

Street food is the ‘independent exception’

Will we ever see a situation where our independent foodservice outlets such as ethnic restaurants and small takeaways disappear from Britain’s high streets? The NPD Group says this is unlikely but independents will find it more difficult to compete against the big brands over the next 10 years. One bright spot is the extraordinary success of street food, although this is still a small part of Britain’s wider foodservice market.

Cyril Lavenant said: “But do remember that many of the big foodservice outlets we know today started as small independents. So there is clearly room for new players but they must offer something exciting and different or they will not succeed.”