Chicken shops dominate UK fast-food market

Footfalls in chicken restaurants surged driven by more openings in Q4.

Fast-food in the UK is undergoing a significant transformation, with chicken shops leading a rapid expansion in store numbers, a phenomenon that can be seen in high streets across the country.

Meaningful Vision's data reveals a tale of extraordinary growth, fierce competition, and the powerful influence of consumer preferences in the evolution of the industry.

2024 saw a surge in chicken restaurant visitor numbers, with a 1.1% increase in traffic in Q4, driven by a 6% rise in store openings. This contrasts sharply with the modest 0.7% growth averaged by the fast-food sector, highlighting the chicken segment’s exceptional performance. This momentum is expected to continue into 2025, fuelled by aggressive expansion from major players.

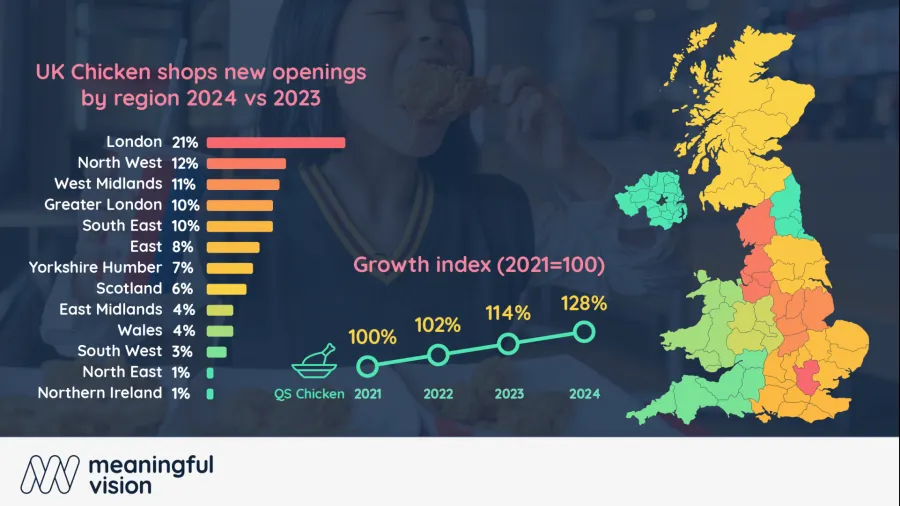

Regional data reveals a significant concentration of chicken chains in specific areas, with London leading at 5.68 per 100,000 people, followed closely by Greater London at 5.46, and the West Midlands at 3.60. These regions are prime targets for expansion, where demand is at its most sustained and robust levels. Chicken shops led growth in store numbers during 2024, outpacing all other fast-food segments by nearly 12%, with London accounting for 21% of new openings, the West Midlands 11%, and Northwest 12%. Over the past four years, the numbers have been even more impressive, reaching almost 30%.

Several key brands are driving the rapid growth in restaurant numbers, with ambitious plans signalling confidence in the market. Popeyes ended 2024 with 65 restaurants, aiming for a staggering 350 by 2031. Wingstop, debuting in 2018, now has 52 locations and plans to add 15 more this year, targeting 200 UK stores. Slim Chickens, with over 55 locations, has six more openings planned for 2025, plus 15 additional sites in the pipeline. These brands, along with new entrants like Chick-A-Fill, Dave’s Chicken, and MB Chicken, are not simply competing with one another, but are actively increasing the chicken segment’s overall share of the fast-food market.

The high number of new store openings clearly illustrates we are witnessing a period of rapid expansion, but what factors are driving this sharp rise in chicken shop numbers? Meaningful Vision CEO Maria Vanifatova notes that chicken's appeal, as a healthy and affordable option, resonates strongly with consumers, especially those struggling with economic pressures. Chicken's versatility lends itself to a range of menu options and tastes, from classic fried chicken to gourmet roast and grilled dishes, attracting a broad customer base.

Meaningful Vision's data suggests this trend will persist. As the UK fast-food market braces for heightened competition in 2025 with new entrants and the ambitious plans of existing operators, chicken chains are poised to capture an even greater market share. Operators who effectively leverage data-driven insights and adapt to evolving consumer preferences by offering compelling menus, will be best positioned for success.