Expansion-led growth triggers slump in existing store visits

Total sector footfall rose by nearly 1% but was fueled entirely by an aggressive 2% increase in new locations.

Restaurant chains like-for-like visits fell 1% in 2025, with overall growth of 0.9% relying entirely on new openings, data from Meaningful Vision revealed.

In 2025, fast-food operators opened close to 1,300 new restaurants. Chicken chains expanded at the most aggressive pace, three times the average rate of other fast-food segments.

While this expansion continues to lift total footfall, it is also intensifying pressure on existing stores, resulting in fewer visits for some restaurants.

Quick-service chicken restaurants were the strongest performers in 2025, with footfall up nearly 6% year-on-year. Bakery and sandwich formats followed with a growth rate of around 3%, whilst coffee shops recorded a 2% increase.

Other categories struggled to maintain momentum. Burger chains saw visits fall by 2%, whilst ethnic fast-food formats also declined. These segments face a combination of rising input costs, with inflation affecting beef prices in particular, and intense competition within increasingly crowded value tiers.

Bakeries accounted for the largest number of new store openings in absolute terms, with Greggs remaining the most prolific operator by volume. Popeyes emerged as the fastest-growing chicken brand in percentage terms.

Meanwhile, expansion has started to decentralise from London. Data from Circana revealed that site numbers only grew 0.6% in 2025.

Meaningful Vision Data revealed that Northern Ireland delivered the strongest growth in 2025, followed by the South of England, reflecting lower saturation levels and more targeted development strategies.

Food and beverage inflation reached around 4.5% by the end of 2025, but fast-food menu prices rose significantly faster at approximately 8% year-on-year to December. This results in a 2.6% increase for 2025, which is more than twice the rate affecting retail prices.

Labour costs remain the primary driver of price inflation and typically account for up to 35% of operating costs.

Minimum wage increases and higher National Insurance contributions have left operators with limited options to meet rising expenses beyond passing the cost on to consumers. Burger chains recorded the steepest menu price increases at around 10%, followed by chicken operators at more than 6%, whilst pizza remained the most price-competitive segment at around 3%.

Promotions shift from tactical to structural

As prices rise, promotions are no longer deployed as tactical tools but have become mechanisms for structural growth. Meaningful Vision data shows that the number of promotions run through brand apps increased by 23%, whilst promotional activity on other delivery platforms more than doubled in 2025.

Average discounts for delivery reached around 30%. Uber Eats, Deliveroo, and Just Eat intensified price competition through deep discounts and free-item promotions, particularly within the pizza segment.

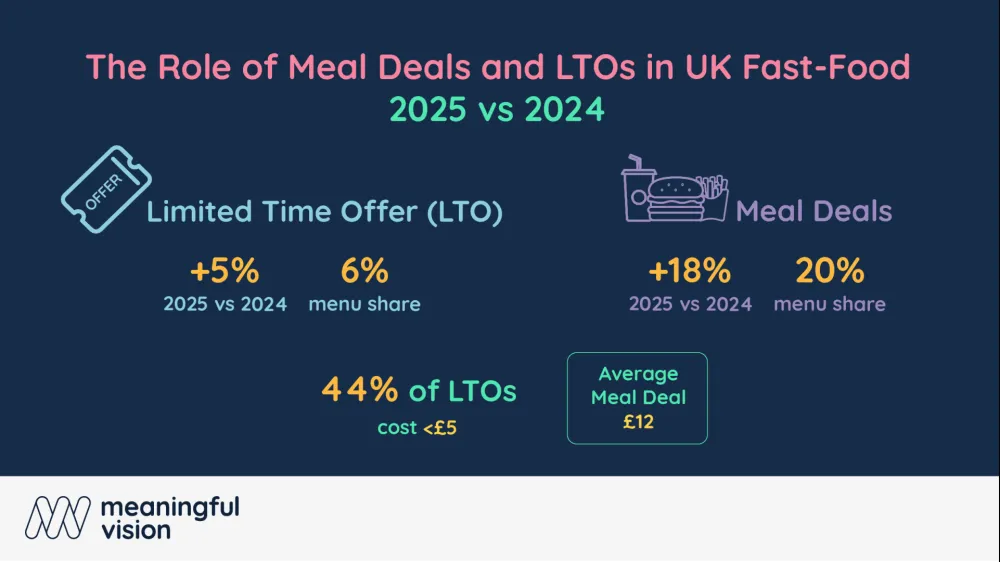

Increasingly, meal deals and limited-time offers play a central role on menus. £5 has emerged as a key psychological price point, even as average meal deal prices continue to rise. Lower-priced LTOs are helping brands drive trial and repeat visits while managing value perception.

Growth with constraints

In 2026, the fast-food industry is expected to remain buoyant, despite predictions that consumers will continue to trade down from casual dining. Premium fast-food and fast-casual formats are particularly well-positioned, supported by stronger digital engagement and value propositions.

Meaningful Vision sees like-for-like traffic remaining under pressure, as expected wage increases will likely translate into further price rises for consumers. In this environment, sustainable growth will depend less on intuition and more on precise information and granular intelligence.

“Rising inflation has fundamentally changed how people eat out,” said Maria Vanifatova, CEO and Founder of Meaningful Vision. “Restaurants and pubs now have fewer choices when it comes to managing price increases and protecting margins, especially with further planned increases to the minimum wage likely to disproportionately affect hospitality. This drives more consumers to trade down, switching to fast-food and fast-casual options, which feel like better value.”

“At the same time, the growth of brands such as Popeyes and Wingstop highlights how new concepts are still finding room to scale in the UK market, especially in the fast-food segment. Premium fast-food brands, in particular, have digital in their DNA and are using that to engage younger audiences. For these reasons, we see the rise of premium fast-food at the expense of casual dining as a long-term trend that will continue through 2026 and into 2027.”