UK fast-food growth slows as new sites split existing demand

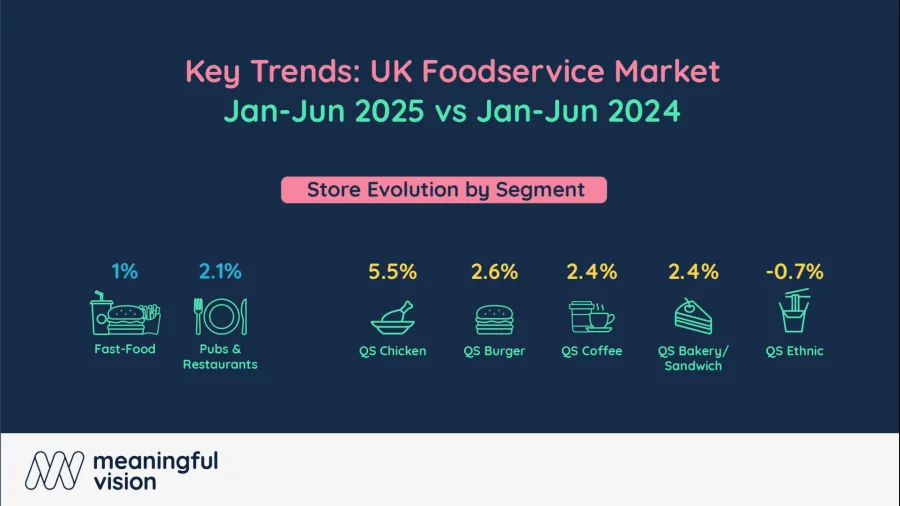

Market expanded 1% in H1 2025 as traffic spreads thin across more outlets.

The UK’s fast-food and casual dining sectors expanded more slowly in the first half of 2025 as new stores divided existing customer traffic rather than generating new visits.

Data from foodservice insight firm Meaningful Vision showed the total store base rose 1% between January and June, less than half the 2.5% increase recorded a year earlier. Fast-food outlets grew 2.1%, down from 4.0% in the same period of 2024, whilst pubs and restaurants contracted 2.1% compared with a 3.8% decline last year.

Within the quick-service restaurant industry, chicken chains led growth at 5.5% but cooled from 12.9% in H1 2024. Burger outlets held steady at 2.6%, bakery and sandwich brands rose 2.4%, coffee matched at 2.4%, and ethnic formats slowed to 2.2%. Pizza chains were the only group to shrink, with net closures of 0.7%.

Meaningful Vision said overall fast-food traffic was slightly higher year-on-year, but like-for-like visits fell, suggesting new openings are pulling demand from existing stores.

“When like-for-like demand is flat, simply adding outlets becomes a limited strategy. Winners will use granular, data-driven location planning and align pricing and promotions to the realities of each neighbourhood,” Maria Vanifatova, CEO of Meaningful Vision, said.

She said the second half of 2025 will test whether brands can maintain growth under these conditions.