UK QSRs meal deal prices outpace individual menu items' growth in Q1

However, this price promotion, along with LTOs, continues to grow.

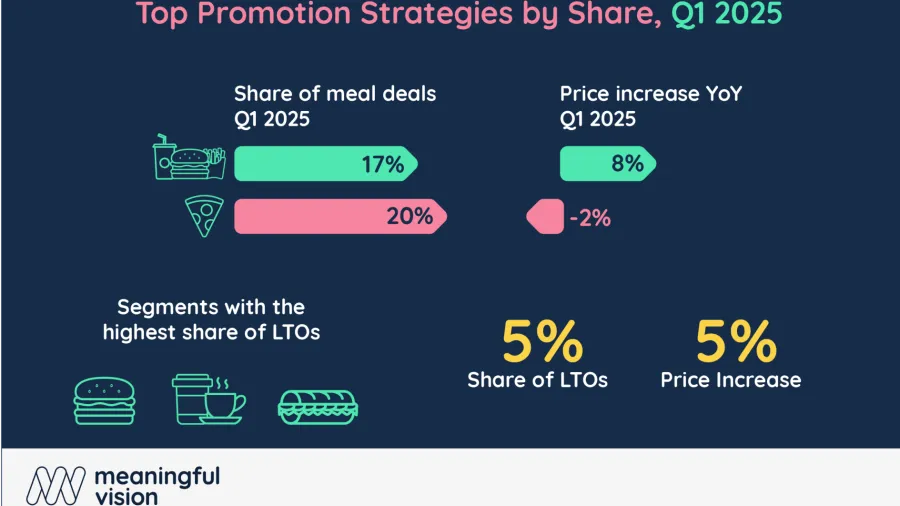

Average meal deals saw an 8% increase year-on-year (YoY), outpacing the price hikes on individual items amidst higher input costs driven by wage increases, packaging inflation, and ongoing pressure on raw materials such as sugar and fruit concentrates in the UK, a report by Meaningful Vision revealed.

Despite this, meal deals and limited-time offers continue to be the top methods for QSR brands to increase engagement with customers and drive growth.

The share of meal deals in fast-food outlets saw a notable increase in Q1, climbing from 15% to 17% year-over-year (YoY). Even more significant was their role in the pizza segment, where robust growth saw the share climb from 16% to 20%.

This indicates a strong consumer appetite for bundled offerings that simplify choices and deliver savings, whether perceived or real.

Pizza meal deals, however, saw a decline of 2% in prices.

“This strategic pricing in the pizza market could be a key factor in its substantial growth in meal deal share, suggesting that price sensitivity continues to play a vital role in this segment,” Meaningful Vision said.

Meanwhile, LTOs constitute approximately 5% of the overall menu offerings, a figure that has remained stable over the past year.

On average, LTOs are priced 5% higher than regular menu items, reflecting their often premium or specialised nature. The segments demonstrating the highest propensity for launching LTOs are burgers, coffee, and sandwiches.

Burger chains consistently lead in LTO innovation, frequently introducing unique combinations or premium ingredients for a limited run, sparking consumer interest and excitement.

Coffee establishments closely follow suit, skilfully utilising seasonal flavours and beverages to stimulate repeat visits and maintain menu freshness.

Similarly, sandwich brands effectively deploy LTOs, featuring limited-run fillings or combinations to differentiate themselves in a competitive market.

“Collectively, these segments exemplify how LTOs can be effectively utilised to boost customer engagement and ensure menus remain fresh, exciting, and relevant,” Meaningful Vision said.