How Smaller Chains are Hungry for Expansion

Casual dining brands in the UK with under 25 sites have grown by 39% over the past three years, opening a combined 489 new outlets across the UK, according to the recent ‘Casual Dining in the UK’ report by Savills.

David Bell, head of leisure at Savills, said: “The significant growth by the smaller brands emphasises the development we’ve seen in new concepts. These smaller chains have provided consumers with more choice and offered a point of difference in the market, and with this success it is driving them to open more sites around the country. Furthermore with the investment from private equity we could see more brands with the capital to grow.”

The research revealed that smaller brands such as Wahaca, Franco Manca and Cau have grown faster than established large brands, adding 489 outlets (+39%) since the end of 2012, compared to brands such as Pizza Express, Prezzo and Nando’s, which have opened 297 (+13%). Savills highlighted that 80% of the casual dining market is made up of brands with fewer than 25 restaurants.

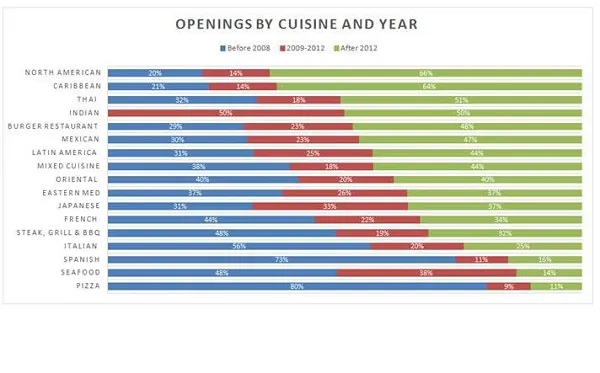

In the report Savills research also showed the growth in different cuisines, with North American, Caribbean and Thai cuisines restaurants having the greatest growth over the past four years. The report noted that 66% of all North American restaurants opened after 2012, compared to 11% of all pizza restaurants, showing a cultural shift in the UK dining market.

Tom Whittington, research director at Savills, said: “Post recession we saw a real boom in the leisure market and that meant the demand for new cuisines from the consumer saw a number of new chains emerging such as Turtle Bay, which is Caribbean, and north American causal dining restaurant Red’s.”