IGD: How should you maximise your chances of success across food-to-go missions?

On your local high street where would you choose to grab a drink in a hurry? Would that be the same place you would choose to buy your lunch?

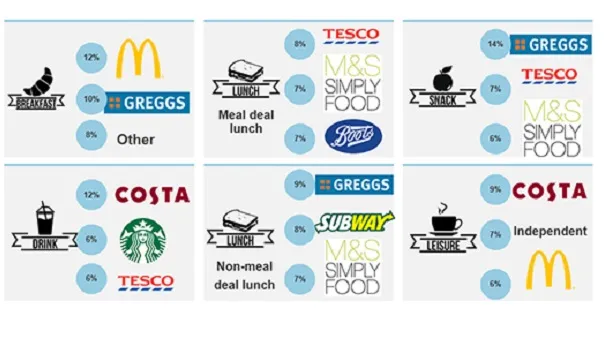

Even across lunch missions the top three choices change completely dependent on whether the shopper is considering buying a meal deal or not.

Shoppers are balancing a number of considerations when deciding where to complete their food-to-go missions, which can be summed up as; product choice and quality, cost and convenience or ease of access.

IGD ShopperVista research has highlighted varying satisfaction levels with these factors across different types, or groups, of operators:

- Sandwich of bakery specialist shoppers are the most satisfied (88%) with the selection of food available (sandwich or bakery specialists include Greggs and Subway)

- Coffee specialist shoppers have the highest levels of satisfaction (88%) with the choice of drinks available (include Costa, Starbucks)

- Food discount shoppers are the happiest when it comes to value for money (90%)

- Food-to-go specialist shoppers (90%) are the happiest when it comes to speed of service (specialists include Pret, EAT)

The experiences of shoppers are driving these differences in satisfaction levels and subsequent preferences for the completion of their missions. For example, the top two places food-to-go shoppers suggested they would complete a non-meal deal lunch were: Greggs and Subway who also have some of the highest levels of satisfaction with the choice of food.

How can you maximise your chances of success in food-to-go?

- If your products are particularly suited to specific food-to-go missions are you targeting the stores and operators which are the favourite of shoppers to maximise the exposure of your products?

- Do your products provide a way to drive improvements in shopper satisfaction for retailers or operators?

- How have you tailored your communications along the path to purchase to show how your products meet the needs of the shoppers of the specific retailer or operator?

- Do you understand the nuances of the food-to-go shopper profiles by channel and is that reflected in your business plans? For example, younger shoppers (aged under 34) are more likely to choose to buy their food-to-go items in a specialist whereas older shoppers (aged over 55) have a higher tendency to use supermarkets.

For more information, click here.

Photo source: IGD, ShopperVista, Food-to-go Oct-Dec 2016