Local Data Company: Growth in shop numbers falls as market slows

Independent stores recorded an eighth straight month of net growth in numbers, whilst multiples plunged -200 in the month.

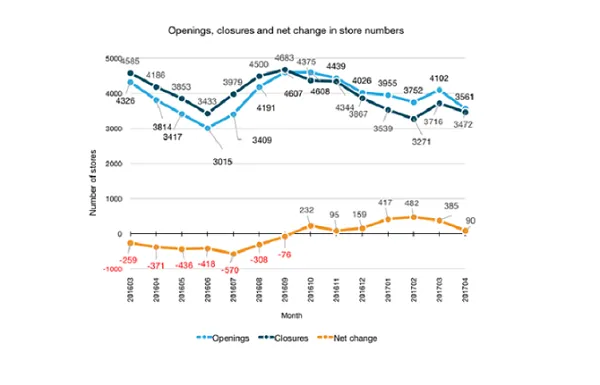

According to research by LDC, seven months of net growth in shop numbers has been welcome, but activity levels have dropped back to mid-2016 figures. The net gain for April was the lowest for more than half a year. A slowing retail economy makes it more likely that the improvement in vacancy since 2012 could come to a halt – and even begin to worsen once more.

Service and Leisure continue to show net growth in numbers, although the gains are becoming smaller month by month. Leisure, in particular, has maintained a positive performance, benefitting from openings by both chains and independents, as coffee shops help to give high streets a caffeine boost.

Service is being driven by independents, with Barbers at the cutting edge of expansion. This market segment is ahead of Leisure on growth, a performance all the more impressive against the background of the consistent loss of financial services outlets such as bank branches, for which more closures are pending.

Convenience provides sporadic periods of growth and as the forthcoming LDC report on Supermarkets, Discounters and Convenience stores will show, growth profiles in all three subsectors changed in 2016 – with supermarkets beginning to fall in number. Comparison shops are still opening, but they are consistently outweighed by closures, and over five years, numbers have dropped by nearly -10,000 net.

Town Centres, Shopping Centres and Retail Parks were all only just on the right side of net growth, as overall net openings have moderated. As the average out of town retail park contains roughly ten units, the April result was the equivalent of about one new park opening. However, as stores in these locations are on average 13 times bigger than Town Centre shops, (Source: analysis of VOA draft rating list 2017) the April gain of +8 units equalled or exceeded the space occupied by the +89 shops added in town locations.

An eight-month run of gains by independents, bumping up shop numbers by more than +2,000, continues. Once again, the increase moderated slightly in April. Multiples, particularly Comparison goods stores (non-food goods) are back on a general reduction path, although the last six months have seen some positive results. In an interesting coincidence, independents gained +289, multiples shuttered -200 net and towns gained +89. Independents continue to favour opening in towns, whilst chains are more likely to close in town high streets.

Vacancy

Retail Vacancy (comprising Comparison, Convenience and Service categories) stuck at the new post-2012 low of 12.0% that it reached in March. It takes a net change in openings or closures of several hundred shops to shift this index by 0.1% either way and the April change was just +90. Other factors also impact this index, including new buildings, demolitions and re-uses. The Leisure Vacancy rate remained close to the 8% level that has been the rule for more than a year. The All Vacancy rate stayed pinned to 10.9% for the third month in a row. The question now, as these measures are effectively becalmed, is - where will they head next?

Matthew Hopkinson, Director at LDC commented: “Contrary to popular belief, the high street is alive and well but with such a large number of high streets that LDC tracks, the variance in performance can be significant. There continues to be good news in terms of net growth in shop numbers. Of note is that contrary to positive signs in a number of the measures, one, Leisure vacancy, is increasing which suggests that the food bubble pigeons that I predicted back in 2015 might be coming home to roost!.”

He added: “It takes some time for day-to-day consumer spending to affect shop numbers and the figures for cash spent within retail have been quite strong. But official statistics for sales volumes suggest that the balance between inflation and earnings growth may cause clouds to appear on the horizon and thus, further stress for retailers and leisure operators where marginal businesses could be forced to close and thus drive up the vacancy rates.”

He concluded: “At the same time with Aldi reported to be considering opening more than 1,000 new stores across the country, on top of the 683 in place at the moment, competition in the high street continues to increase.”