Squeeze on household to slacken, good news for foodservice sector: analyst.

Numbers from the Office for National Statistics are showing stabilising signs.

The good news for the foodservice sector is that the squeeze on household budgets will abate, leaving some slack for consumers to start spending again, analyst Peter Backman said.

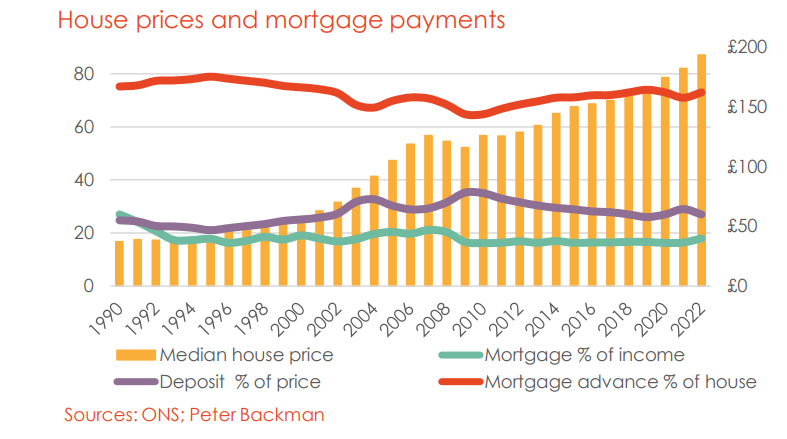

“House prices are astronomically high. Mortgage costs as a share of income are unaffordable. Interest rates are going through the roof. And so people are unable to get on the housing ladder and for those that do, household budgets are squeezed – and as a result, people, especially the young, are unable to spend on things like eating out,” Backman said.

Citing data from the Office for National Statistics, Backman said mortgage payments for first-time house buyers as a percent of income were 18.9% - only slightly higher than the figure for all house buyers last year. Backman also noticed that mortgage advances were 3.5 times incomes The required deposit for a house was 27% of the asking price.

“These are average figures from the Office for National Statistics, and they will, no doubt, vary probably widely across the economy. But what strikes me about the figures is how stable they have been for the last twenty-five years and more. There was a shudder at the time of the Great Recession fifteen years ago, but things returned to normal within a couple of years.”.

“Mortgage lenders are prudent by nature and because the fundamentals of lending remain the same, the tests they apply to things like affordability and ability to repay loans remain pretty stable over time. There is clearly pain for several million people, but the long-run figures demonstrate that the numbers will almost certainly return to affordable levels before long. And that means that the squeeze on household budgets will abate, leaving some slack for consumers to start spending again,’ Backman said.