EXCLUSIVE: Is there shopper appetite for Subway's expansion plans?

At the start of July, Subway announced plans to open up to 500 stores over the next three years, taking its potential estate to 3,000 in the UK and Ireland by 2020. Is the shopper appetite there to support this growth? The short answer is yes, particularly as the business evolves its proposition to take new shopper priorities into account. Here, Rhian Thomas, Shopper Insight Manager at IGD, looks at the top three considerations for Subway as it rolls out its plans.

1. The profile of the Subway shopper

Subway shoppers are more likely to be male compared to the average (57% vs. 48%) but more importantly they are, on average, nearly 10 years younger (38.8yrs vs. 49.1yrs). In fact, nearly half of its shoppers are under the age of the 34, with 19% being aged between 18 and 24 and a further 28% between 25 and 34 years old.

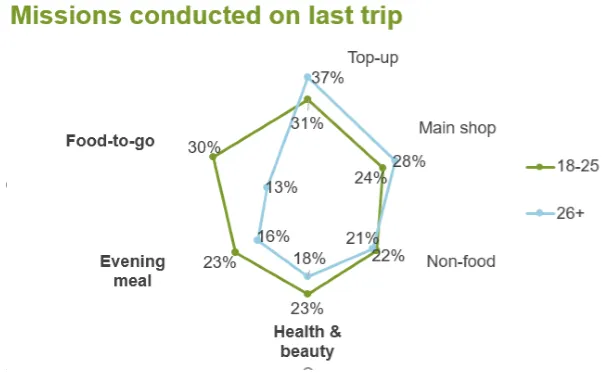

Our recent research exploring the attitudes and behaviours of post millennial shoppers (those aged between 18 and 25 years old) found that this group are more likely to complete food-to-go missions than almost any other food and grocery mission.

This generation of shoppers are often time poor and searching for convenient solutions that fit in with their lifestyles; something which food-to-go offers. As part of Subway’s estate expansion, locations that provide both high footfall and access to younger shoppers should prove successful.

2. Opportunities beyond lunch

Part of Subway’s expansion announcement talked about its plans to upgrade what it offers at different times of day, particularly breakfast and later into the evening. This offers potential to expand its appeal to existing shoppers and increase the brand’s relevance more widely. Half (51%) of Subway shoppers have bought breakfast-to-go in the last four weeks compared to 27% of all food-to-go-shoppers, so the demand is clearly there.

The opportunity for Subway is around shifting shoppers’ mindsets in terms of the missions that it can cater for. Amongst its own shoppers Subway features in the top three considered outlets for all missions, except for the drinks mission, but it only actually tops the list for lunch. Ensuring that it spreads the message about its extended ranges amongst its existing shopper base is the first step. Could stronger breakfast and evening meal offers also encourage a larger number of food-to-go shoppers to consider Subway as one of their top three outlets?

3. Innovation in health is welcome

For nearly three-quarters of Subway shoppers, the range of healthy options available is an important consideration in choosing where to complete their food-to-go missions. The recent introduction of salads is a step towards expanding its healthy options, but there is room for further development.

While health can mean many different things to shoppers, Subway shoppers are specifically seeking more choice when it comes to vegetarian ranges (43% vs. 32% average), dairy free (37% vs. 23% average) and gluten free (33% vs. 21% average). Bringing product innovation and range extensions together to account for both different times of day and different health issues should further support Subway’s expansion plans.

For more information about the Subway shopper, read IGD’s ShopperVista report.

If you want to learn more about the food-to-go market, join us later this year at IGD’s Food-to-Go Conference. Whether you’re fully-fledged in Food-to-Go or about to get going, attend the event that serves up practical learnings. Click here for more information.