News

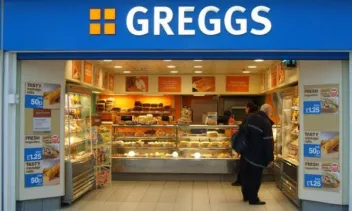

Greggs to launch vegan sausage rolls by 2019, PETA claims

Greggs to launch vegan sausage rolls by 2019, PETA claims

The information is said to have been from a leaked email of a Greggs representative.

UK Hospitality says government's new migration proposal will harm economy

The trade body believes that this will not benefit UK businesses.

YO! Sushi partners with Cineworld to offer 25% discount on food and drinks

The news follows after the cinema chain has also partnered with Casual DIning Group.

Deliveroo gives away biodegradable greaseproof papers to allow recycling pizza boxes

They also announced that they ended the year with 10,000 more delivery riders.

Jollibee now 100% owner of US burger chain Smashburger

The fast food company aims to expand the burger chain business in the US, Philippines, China and Vietnam.

Other Side Fried to launch new store in Leicester Square

The outlet will be serving as a takeaway venue.

Detox Kitchen reaches £550,000 funding target

The funds will be used for initiatives such as expanding kitchen capacity and investing in a tech platform for delivery.

63% of pub and restaurant chain operators optimistic of business for the next 12 months: survey

Half of its respondents, however, expected lower consumer frequency in eating outside.

Élan opens new store in Hans Crescent

This is their fifth site in London.

Vapiano launches a new store in West End

The chain also mentioned that they will be opening a new site in Glasgow next year.

Just Eat, Deliveroo and McDonald's in talks with Transport for London against junk food ad ban: report

Some of these companies are said to be thinking about taking legal action.

McDonald's says their new antibiotic policy on beef responds to “critical” public health issue

The fast food giant will report their progress on this on 2022.

Operator of Franco Manca and The Real Greek reports 20% revenue growth for HY19

The company’s growth is said to be driven by new openings and adding vegan and gluten-free options.

Ole & Steen launches new flagship store in Central Cross

This is their tenth site in the UK.

Crussh to launch new site in London Bridge on 2019

This will be their second site in partnership with SSP Group.

PizzaExpress unveils new Christmas menu

The pizza chain introduces two new pizzas and brought back their Snowball Dough Balls.

Pub and restaurant chains see 1.5% like-for-like sales growth in November, study says

The sales of chains operating in London have outpaced the growth of businesses from the rest of Britain.