Exclusive: Latest data reveals food service inflation slows by 6% in H2

Since June 2023 foodservice price inflation has consistently decreased.

According to the latest data from Meaningful Vision who are tracking the top 100 chains amongst fast food, coffee shops and casual dining, the major fast-food chains experienced an average 16% price increase in the second half of 2023 when compared with the previous year. Since June 2023 foodservice price inflation has consistently decreased, with November witnessing the smallest month-on-month average price rise, at 13%, intensifying the trend seen throughout this period toward less significant month-on-month price increases.

Analysis reveals the decline in the rate of price increases over the last six months amounts to an average of 6% across the industry. However, this rate is not applicable to all products across all sectors, Meaningful Vision’s reporting reveals price increases differ markedly: slowdown in price growth was more evident for dine-in and takeaway vs delivery, for food items vs beverages, and for higher premium products vs lower priced products.

Price increases for dine-in and takeaway decline but at different rates

Meaningful Vision’s latest report demonstrates that foodservice price inflation affecting major aggregators such as Deliveroo, JustEat and Uber, was 5% higher than equivalent prices for dining-in during the second half of 2023, continuing a trend that has seen price increases for dine-in restaurants decline from 15% in 2022 to 10% for 2023, whilst price increases for food delivery declined from 20% to 15% in the same period. Delivery is increasingly more expensive than dine-in or takeaway alternatives as the decline in price increases for this sector is happening at a slower rate than elsewhere in the industry.

Rate of food price increases slows more rapidly for higher-priced items

A closer look at individual menu categories reveals that price movements across the product ranges offered are not uniform. Price increases amongst food items showed more slowdown than those for beverages in the last 6 months. Non-alcoholic drinks saw a 12% increase in prices continuing the relatively steady month on-month rate seen in the latter half of 2023, whereas food prices increased 13% in November, a significant reduction over the high of 19% seen earlier in the period under review. The price increase of cheaper products, those in the sub £2 range, remained consistent at 24%, whilst items priced in the £5 to £10 range slowed from 14 - 15% to 10%. By contrast, premium items priced at £15+ saw the rate of increases slow from 12% to 6%.

Price increases vary between different sub-categories

Meaningful Vision’s data analysis of individual menu categories reveals that on average, price increases for main meals were lower than for snacks during the 2nd half of the year, and the rate of price increases for these products has slowed more rapidly. Price increases applicable to main meal categories like burgers, sandwiches, pizza and meal deals, have slowed significantly over the 6 month period under review. By contrast, snack categories such as cookies, cakes, snacks and sweet bakery items all experienced continued price increases in November. Hot drinks, ice cream, soup and salad prices showed the highest price growth during 2nd half of 2023, while burgers, sandwiches, meal/combo offers, and pizza demonstrated the lowest growth rates.

Rate of price increase varies between different regions and cities

An examination of our data on a regional basis shows price increases declining in tandem with overall rates nationwide, however a closer inspection of prices in a variety of UK cities reveals differences of as much as 20-25% between various locations. In the 2nd half of 2023 price increases declined by an average of 4-8%, depending on the region, with Belfast and Manchester demonstrating more rapid decline than other regions.

Trends, Challenges, and Strategies in H2 2023

The UK’s Office for National Statistics reported the core CPIH annual inflation rate was 5.2% in November 2023, while prices for food and beverages went up by 9%. Additionally, it reports a slowdown in the rate of price increases for the food and beverage sector by 8%, from 17% to 9% in the latter half of 2023.

"While decreasing food price inflation is potentially good news for both operators and consumers, it must be noted that fast-food, coffee shop and casual dining prices increased with greater rapidity than the general inflation rate for the food and beverage sector, including retail" - Meaningful Vision CEO Maria Vanifatova remarks. "However, limitations imposed on operators by a decline on the side of consumer demand could result in restrictions against further price increases."

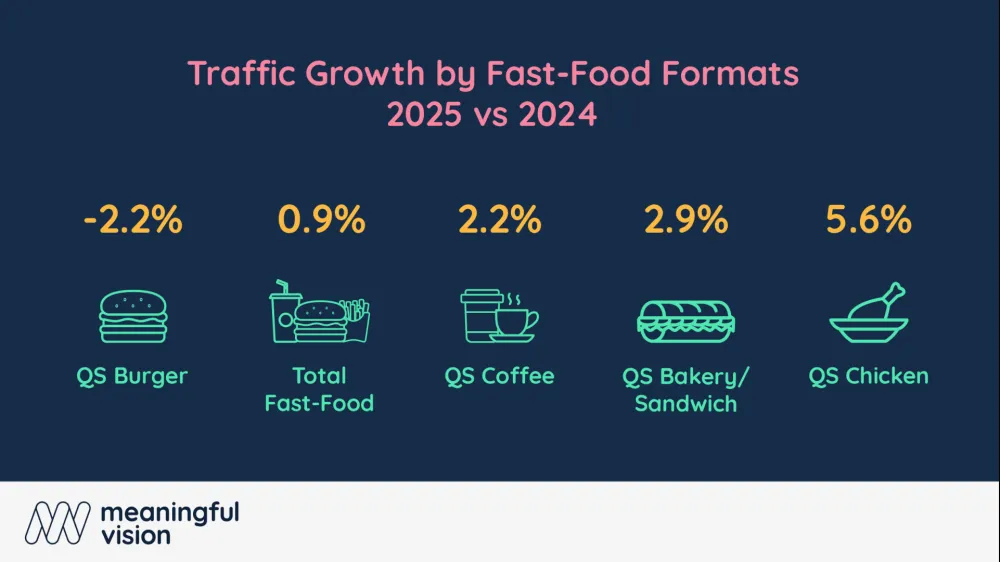

According to Meaningful Vision data, despite the 6% slowdown in price rises, overall traffic decreased by 3% in the second half of 2023. Even in the budget-friendly fast-food segment, with a commendable 4% growth of footfall in Q2, growth stalls from September onwards. November sees a stark 3% decline in traffic compared to the previous year.

Safely navigating the current economic conditions will require the foodservice industry to employ various instruments to spur consumer demand, beyond merely increasing or decreasing prices, examples include differentiated pricing, meal deals and promotions. A weighted pricing policy, based on extensive knowledge of the competitive environment such as Meaningful Vision’s market insights provide, will continue to be crucial for restaurants in 2024.”