How UK shoppers perceive value at Food To Go retailers

With the busy and flexible lifestyle of shoppers, food to go is forecasted to grow 35% to £21.7 bn in 2021. With this backdrop recent research also suggests consumers perceptions of value is out of kilter with actual prices, offering avenues of opportunity for the sector.

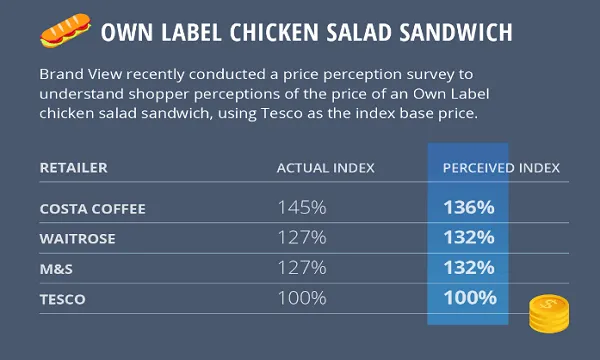

The price and promotions analytics company Brand View recently conducted a price perception survey to understand shopper perceptions of the price of a variety of goods at various food to go outlets.

The survey revealed that shoppers perceived the price of food and drink items at Food to Go retailers to be cheaper than they actually were, while retailers such as Waitrose and Marks and Spencer were incorrectly perceived to be more expensive.

In reality, food to go outlets typically sell items at a 30 to 40% premium over that of supermarket stores. For example, a 250ml Innocent Mango and Passionfruit Smoothie 250ml was being sold for £1.60 in Sainsbury’s and £2.15 in Starbucks.

However, when asked about the price of own brand chicken sandwiches at various outlets, the results were surprising. Using Tesco as a base (of 100%) the research showed that the perceived price of a similar sandwich at Costa was 136% vs an actual price of 145%, whereas at Waitrose and Marks and Spencer the perceived price was 132% vs an actual price of 127%.

According to the Brand View report, 20% of shoppers are purchasing lunch on-the-go more than twice a week, while a total of 48% shoppers are purchasing hot drinks.

Supermarkets are the most popular places to buy: hot drinks (30%) and breakfast (27%).