How UK’s coffee segment has evolved according to Costa Coffee

The brand analysed millions of transactions across its stores for the last 24 months.

Costa Coffee has released the findings of its Lattenomics report, which explores the UK’s changing coffee consumption habits, the influences that shape it, and the impact on wider high street and societal culture.

The coffee brand analysed millions of transactions across more than 2,700 of its coffee shops over the last 24 months.

The report found out three main things. First, there is an increased presence of coffee shops on high streets and how the use of coffee shops is changing. The second is how coffee shops are responding to the rise in hybrid and remote working and the third is how consumer demand is driving innovation across the segment.

High street

Citing a report from Allegra World Coffee Portal, Costa Coffee revealed that the total number of coffee shops in the UK grew by 353 in the last 12 months, with coffee retail outlets predicted to reach 11,600 by January 2029.

This shows the importance of high streets as they are hubs for communities and a gathering for people of all ages.

“Where you've got major chain anchors and a good array of independents, these are good, diverse, high-street locations. These are the ones we see thriving. Because of this, Costa Coffee has a significant role to play on our high streets,” Nick Ridley, Property Director for Costa Coffee said.

In the high street, the way people use Costa’s spaces has changed. This reflects how the high street is being transformed. For example, the report revealed that the number of people visiting Costa Coffee stores at the weekend has remained fairly consistent over the last two years, with a slight rise in numbers on Fridays and Sundays, suggesting that coffee stores are becoming places to stop and relax, rather than to grab coffee and go.

Meanwhile, the effect of inflation can also be analysed in how people spend in high street locations.

According to a report by Barclays last year, restaurant spending plunged 10.8% month-on-month in September, almost double the previous decline of 5.8% a month before.

Costa’s report said coffee shops like theirs are not seeing the same impact, which could be attributed to the Lipstick Effect, where sales of affordable luxuries, such as lipstick – or in this case, coffee – rise in economic downturns.

“It's going to continue to be a challenging time for consumers and so I think people look for these more interesting and exciting products as a bit of escapism. Limited editions, new flavours and innovative multi-sensory drinks will continue to fulfil this role for people, especially for those under the age of 35,” Sandra Ferreira, Beverage Innovation Director at Costa Coffee said.

On the go

Data from the Office for National Statistics (ONS) in April revealed that 23% of UK employees work from home some of the time.

This trend is matched by Costa Coffee’s data. Footfall patterns at key Costa Coffee locations have much to tell about working patterns and five-day return-to-office mandates.

The first months of 2024 have seen a continuation of the office/work habits that have developed post-Covid. For every 100 weekday customers to city centre outlets, 65 of them are going in on Tuesday, Wednesday, or Thursday. The average Tuesday, Wednesday, and Thursday have 26% more customers than the average Monday and Friday. The proportion of weekday transactions taking place on Tuesday, Wednesday, and Thursday has slightly risen from the same period in 2023.

“From a morning wake-up to an afternoon pick-me-up, coffee plays an integral part in our working day and routines, whether that’s from home or in an office environment. People who are no longer tied to one place of work are using our coffee stores more generally as places to meet and places to focus,” Ridley said.

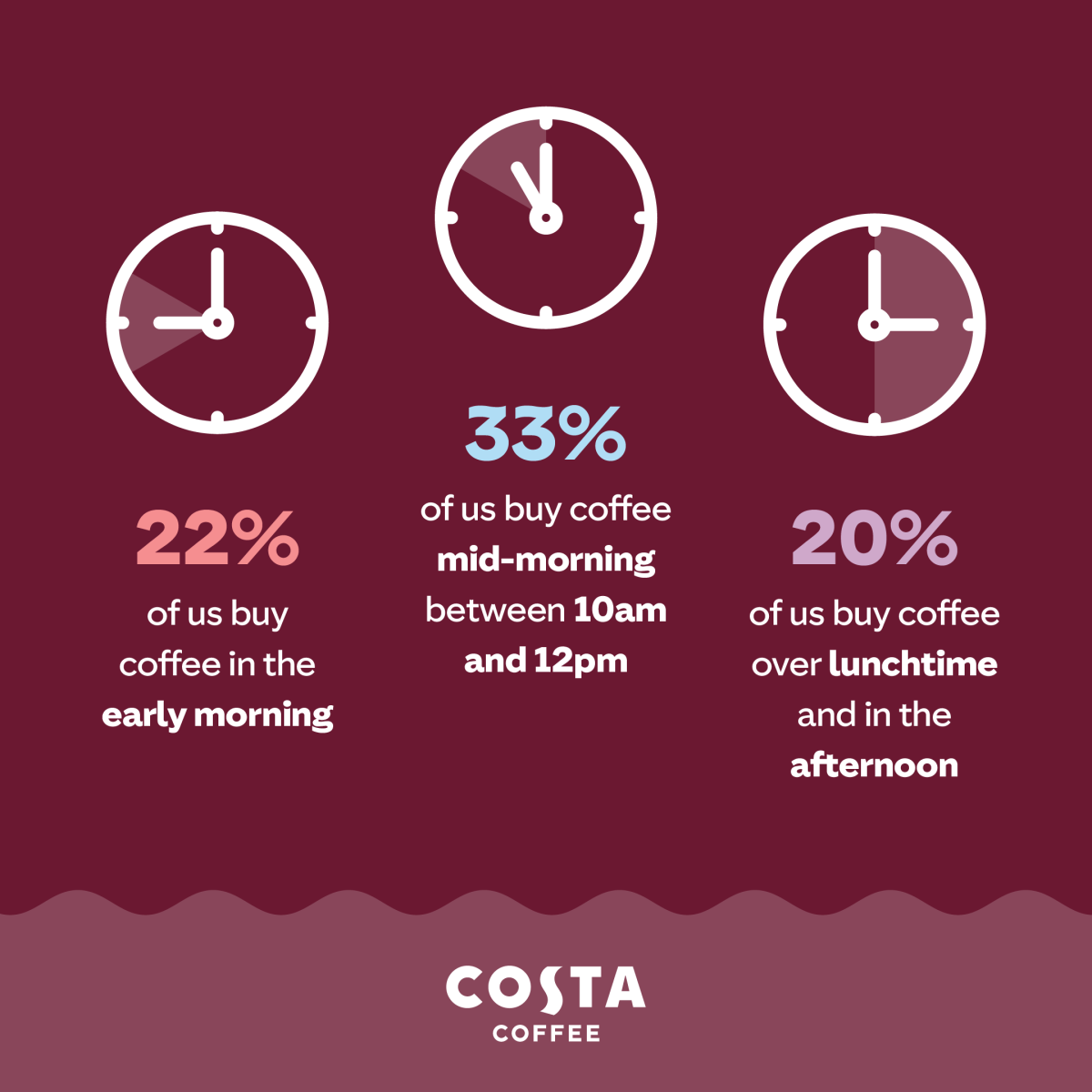

Notable findings by Costa’s report revealed that 22% of consumers buy coffee in the early morning, 33% buy coffee in the mid-morning between 10 AM and 12 PM, whilst 20% buy coffee over lunchtime and in the afternoon.

However, the location where people are purchasing coffee is changing in response to the shift in the world of work. The number of Drive-Thru coffee stores has grown by 15.1% over the last 12 months, and Costa Coffee operates 43% of these – 362 out of a total of 801 Drive-Thru sites nationally.

“We used to see the majority of our sales from our high street stores. Now we're seeing a shift in how people are shopping and as a result seeing far more diverse coffee consumption locations, such as in Drive-Thrus, retail parks and at shopping centres,” Ferreira said attributing this to a rising demand for convenience.

Ready-to-drink range have become a rising segment as well with 20% of consumers aged under 35 buying RTDs compared with only 6.6% of those over 55.

Changing taste

The top three most ordered coffee at Costa Coffee in the last 12 months were lattes (66%), cappuccinos (44%), and flat whites (33.7%)

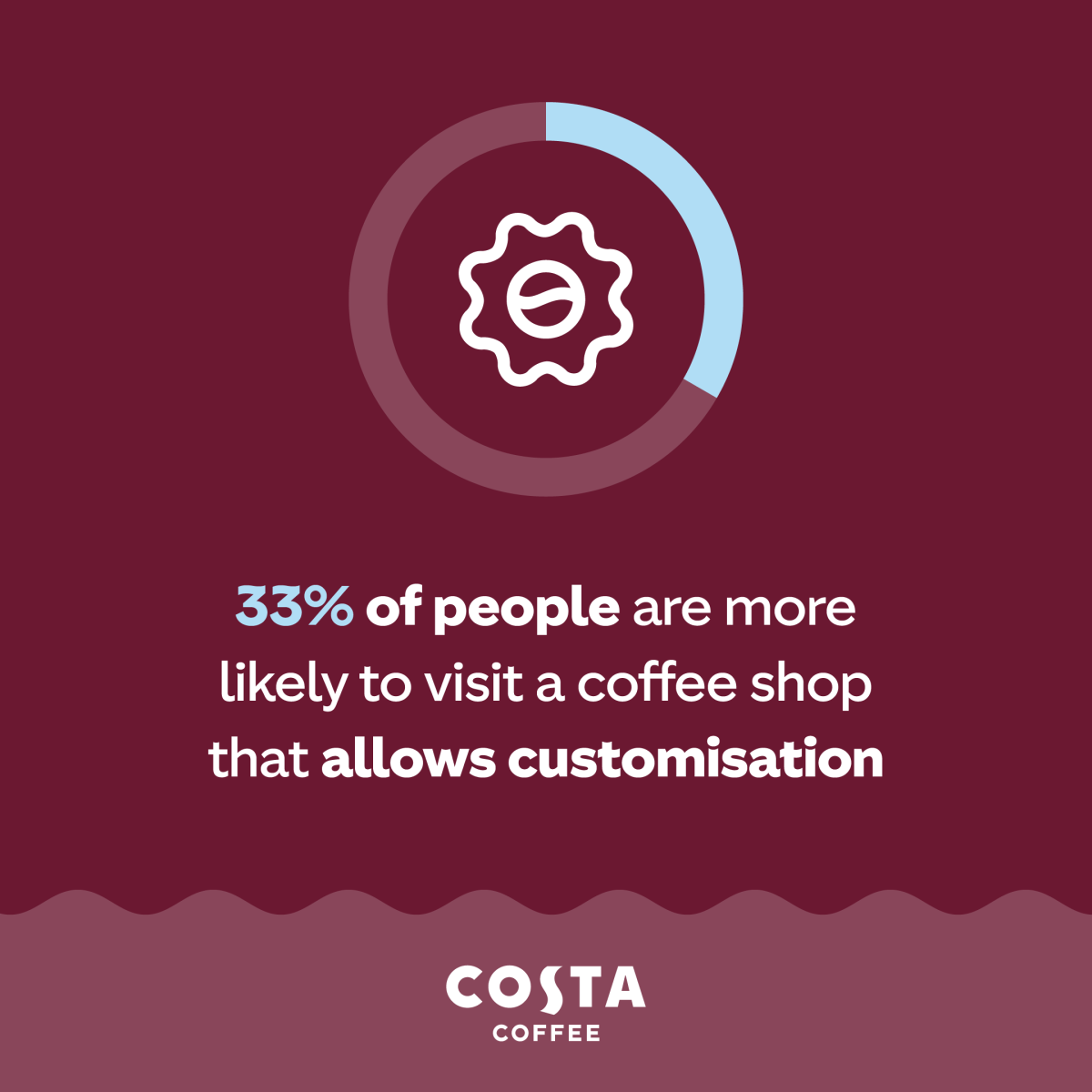

However, sales data showed that 36.4% of consumers like to customise their coffee and align it with their milk preferences. Oat milk is now the third most likely option with coffee, with around 31.4% ordering it.

Another trend is the rise in popularity of cold drinks however, this just means that Costa Coffee had to innovate their hot drinks segment in other ways.

“We’re seeing a significant growth in iced drinks, and this is spurring us on to innovate in other ways,” Ridley said. To give an example, this year Costa Coffee launched three kinds of Hot Milkshake: White Chocolate and Strawberry, Salted Caramel Coffee, and Chocolate Hazel Hot Milkshake. The innovative product triggered a media frenzy and saw over a million sales in the UK since hitting the menu.

Another trend is demand for more customisation.

Coffee data shows that 40% of customers like to add a flavour syrup to their hot beverage when given the chance, with the most popular flavours being caramel, vanilla, and hazelnut. However, the data also shows that flavour syrups are most popular with younger consumers (34% Gen Z vs 5.3% over 55s).

Moreover, research from Costa Coffee’s ‘Store Of The Future,’ a new store re-design programme launched in 2023 also found that people are twice as likely to customise their coffee when ordering via a digital ordering screen, rather than over the counter, sighting judgement as a barrier to customisation.

“Alongside customisation, people also want a multi-sensory experience with their drinks and we’re seeing a growth in demand for texture in drinks with the addition of cold foams and bubbles, e.g. a Mango Frappe with bubbles, or Iced Whipped Lattes,” Ferreira said.