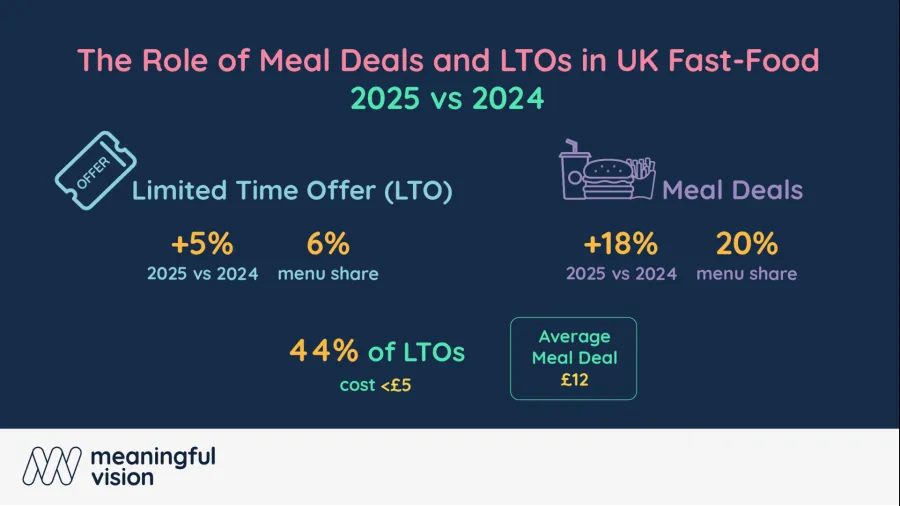

Meal deals hit 20% of menus as LTO prices plunge 12%

Limited-time offers now make up 6% of the average menu.

Meal deals have become the core growth drivers for many fast food operators in the UK, with them accounting for 20% of fast-food menu items in 2025, up from 17% a year before, according to data from Meaningful Vision.

The report took note that some brands that had not previously used meal deals in their marketing tactics have started to do so, such as Pret A Manger, Paul, and Wasabi.

Price architecture is tightening around key thresholds. £5 has emerged as a psychological anchor, even if the average meal deal price has climbed to £11.74.

Defending the £5 price point, established players such as Greggs, McDonald’s and KFC, are competing against a slew of recent entrants to the market, including brands like Popeyes, Wendy’s and German Doner Kebab.

Limited-time Oofers are playing an important role in stimulating the frequency of visits and new trials. According to Meaningful Vision analysis, LTOs now make up almost 6% of the average fast-food menu, having grown by 5% in 2025.

Notably, 44% of LTOs are priced below £5, and despite inflation, the average LTO price fell by 12% year-on-year. This makes LTOs a lower-risk way to drive trials, encourage repeat visits and introduce new flavours or formats without permanently raising menu prices.

Established brands are leaning heavily into creative LTOs, often built around partnerships, iconic moments in pop culture, or social media trends.

Amongst recent offers are World Menu Heist from McDonalds, KFC Collaboration with ‘Stranger Things’ and guest-inspired products from McDonalds and Burger King. These offers are not only attracting new customers but also re-engaging existing ones, particularly younger audiences who are more responsive to novelty and limited availability.

“Meal deals and LTOs have become structural tools rather than short-term tactics,” said Maria Vanifatova, CEO and Founder of Meaningful Vision. “With prices rising and demand under pressure, brands are using these formats to protect value perception, stimulate trial and keep menus feeling fresh without relying on blanket discounting.”

Competition around value is set to intensify. As more brands crowd into similar price points, the winners will be those that use data to refine offer design, timing and targeting, ensuring that meal deals and LTOs drive incremental demand rather than simply eroding margins.