9 in 10 consumers reported an increase in their cost of living

An analyst reveals a worrying trend where consumers dip into their savings.

Consumers are grappling with a cost of living crisis as prices for essential goods and services continue to surge, whilst salaries and wages fail to keep up with the escalating expenses. This alarming trend has raised concerns about the financial well-being of individuals and families, as the gap between rising costs and dwindling incomes spells trouble for households worldwide, analyst Peter Backman said.

According to Backman, the latest ONS findings reveal that a staggering 95% of respondents reported an increase in their cost of living compared to a year ago. This widespread sentiment reflects the prevailing belief that expenses are spiralling out of control.

However, when examining the changes over the past month, a different picture emerges. Approximately 60% of respondents noted a rise in costs, indicating that the rate at which the cost of living is increasing is on the decline.

“This suggests to me that while most people see the cost of living increasing, the rate at which it’s increasing is falling. So that’s a good thing,” Backman said.

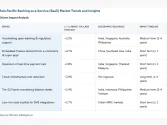

Analyzing the components of these changes, Backman identifies several influential factors. The most significant contributors are the surging prices of food, housing costs, elevated gas and electricity expenses, and the rising cost of petrol. Interestingly, consumers have observed a decline in their petrol bills over the past ten months, while gas and electricity prices have also recently started to decrease noticeably. However, concerns regarding food and housing costs continue to mount, causing further unease among consumers.

To cope with these escalating expenses, consumers have implemented various strategies. Many have resorted to cutting back on non-essential spending, reducing their consumption of gas and electricity, and limiting non-essential journeys. Encouragingly, consumers have also shown increased efficiency in energy usage, suggesting a positive response to the crisis.

Nonetheless, recent figures suggest that these coping mechanisms are reaching their limits. Rather than continuing to cut back, consumers have increasingly relied on credit cards and have begun dipping into their savings. This notable upswing in drawing on savings in the past three months signifies a critical shift in the financial resources available to consumers. With fewer avenues to reduce spending, individuals and families are compelled to dig deeper into their financial reserves to counter the rising cost of living.

“This means that consumers’ response to the cost of living crisis may be entering a new – and worrying - phase in which they draw on the financial fat they have built up over the years. When that runs out, then what happens?,” Backman said.