In Focus

2018: Year In Review

2018: Year In Review

From Brexit-driven cost pressures to a bakery chain’s multi-million accounting hole, here are the top themes from the UK’s QSR space in 2018.

2018's Hottest Stories

Get a summary of the biggest and most-read stories these past 12 months.

EXCLUSIVE: Top 10 Australian and Asian QSRs that are not in the UK

Some of the brands made global headlines for their aggressive expansion plans.

EXCLUSIVE: Pizza Hut Europe aims to have the ‘easiest and richest' loyalty programme in delivery

The UK is the first stop of their Hut Rewards initiative.

5 Ways to Keep Ahead in a Changing Food-to-Go Market

Market research company IGD lists down their learnings in their Food-To-Go 2018 event.

EXCLUSIVE: Chilango on their Low Cal Menu Success and Christmas Specials

The Mexican chain also teased of a new campaign in January with range of dishes below 498 calories.

EXCLUSIVE: How the coffee trend has been evolving, according to Euromonitor

Coffee is being consumed in various occasions, a role that is previously served by carbonated drinks.

EXCLUSIVE: Taco Bell's London comeback, and how they plan to expand their UK footprint

International president Liz Williams says the Mexican fast food chain is primed for significant growth opportunities in the city.

EXCLUSIVE: U.S.-based Slim Chickens to enter Wales, eyes more UK stores in 2019

This follows the launch of their flagship London restaurant.

EXCLUSIVE: Costa Discuss New Winter Menu

The new ranges will replace their autumn menu on November 1.

EXCLUSIVE: How YO! Sushi is aiming for a bigger share of the food-to-go market

The Japanese chain is looking to make their offerings more accessible.

EXCLUSIVE: LEON eyes more affordable plant-based options amid growing vegan population

Their recently-released autumn menu has vegan choices under £5.

Food-to-go market up by £2.5 billion since mid-2015, report says

The NPD Group says foodservice operators can make money from Britons’ “voracious appetite” for eating on the go.

EXCLUSIVE: ICHIBUNS brands their buns with readable QR code

See how the Japanese chain aims to “make the wallet industry more exciting and dynamic.”

EXCLUSIVE: Uber Eats on Leveraging their Platform to Boost Restaurant Sales

Find out they plan to create more revenue opportunities for their restaurant partners.

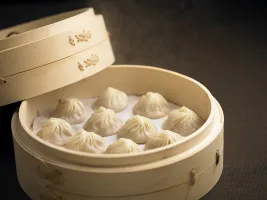

EXCLUSIVE: Din Tai Fung on why now is the right time to enter the UK market

Learn more about their upcoming London debut and whether their menu will change for the UK market.

Reservations only: McDonald's trials luxury restaurant concept with gourmet-style burger range

The fast food giant is also exploring the possibility of rolling out the premium concept restaurant for special occasions.