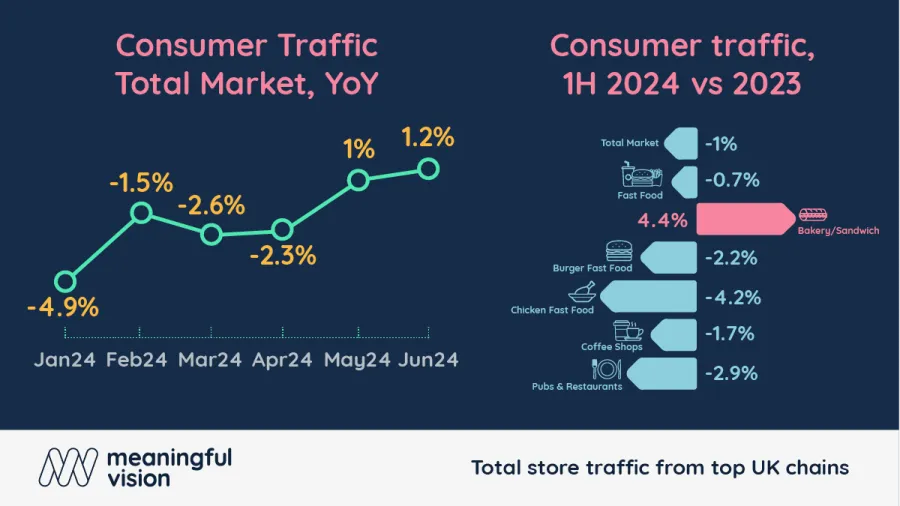

Bakery and Sandwich traffic only segment to grow in H1

Traffic dropped by 1% overall.

Meaningful Vision's latest report, featuring an in-depth analysis of data gathered in the first half of 2024, reveals the foodservice industry is experiencing reasonably uneven patterns of consumer traffic across various segments.

Overall, the market witnessed a slight decline in traffic, dropping by 1% year-over-year (YoY). This trend reflects a continuation of the downward trajectory observed in the latter half of 2023, primarily influenced by high inflation and commensurate shifts in consumer behaviour.

According to Meaningful Vision, this number does not tell the whole story, however, as some sectors have seen traffic increase, whilst others have seen decreases greater than this median average.

Key Segment Insights

Fast-Food: The fast-food segment experienced a modest decline of 0.7%. Whilst this decrease is smaller than seen elsewhere, it signals a challenging environment for operators. Popular fast-food options such as fried chicken and burgers saw notable traffic reductions of 4.2% and 2.2%, respectively.

Despite the arrival in the UK of American chains like Popeyes, Wendy’s, and Wingstop, the segment in general is struggling to maintain previous levels of consumer engagement.

Bakery and Sandwich Outlets: Standing out positively, with a 4.4% increase in traffic primarily attributable to rapid expansion into many new locations, both in big cities, and suburban areas, are Bakeries and Sandwich shops.

Chains such as Greggs, Gails, and Pret A Manger are the major drivers of this growth with a 5% rate. However, like-for-like traffic in bakeries remains negative, as it does for all other segments.

Coffee Shops: Coffee shops faced a slight decline in traffic, down 1.7%. This segment in particular has shown resilience, especially in the morning hours, driven by promotional activities and a growing preference among consumers for breakfast items. The slowdown is relatively modest compared to other segments, indicating stable customer interest.

Casual Dining and Pubs: Casual dining restaurants saw a drop in traffic by 5.8%, while pubs managed modest growth of 1%. The performance of pubs was notably buoyed by the European Cup in June, which traditionally attracts large crowds.

However, the overall decline in casual dining reflects a broader trend of consumers opting for more cost-effective meal options amid the pressures caused by rising inflation.

“Whilst segments like bakeries and sandwich shops have shown resilience, others have not fared as well. The foodservice market in general endured a challenging first half of 2024, with a 1% decline in consumer traffic. The industry is tasked with navigating a successful passage through somewhat turbulent times, and operators looking to retain and expand their customer base will be well served to focus on innovation in an effort to adapt to the prevailing conditions,” Maria Vanifatova, CEO of Meaningful Vision Ltd, said