Breakfast boom drives UK fast-food traffic

Evening traffic, however, declined, with most choosing to eat at home.

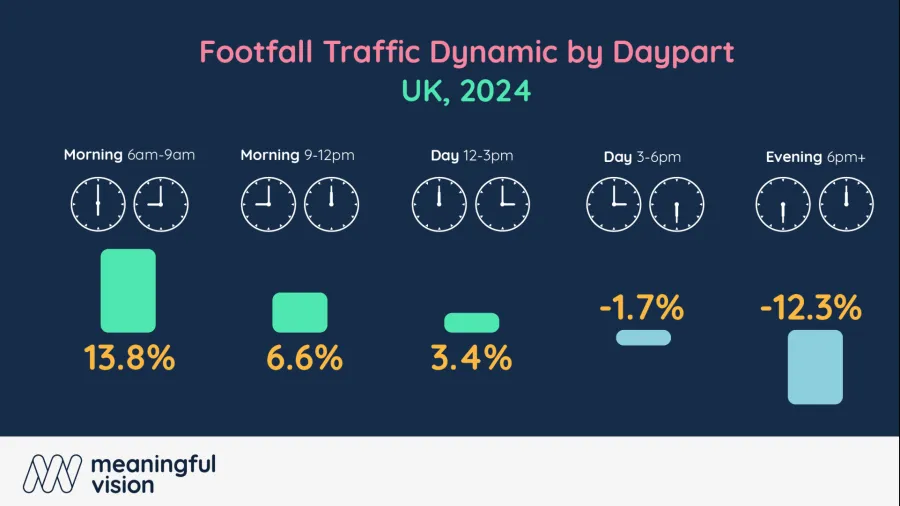

Footfall traffic dynamics in the UK’s foodservice industry are shifting significantly, with a clear trend favouring morning visits over evening traffic.

Data from Meaningful Vision revealed that morning traffic before 12 PM increased by 8% in 2024, raising its share of total daily visits from 23% to 25%. Meanwhile, late-day and evening footfall experienced a decline of 12% as consumers adjusted their dining habits in response to economic conditions and changing work routines.

Meaningful Vision attributed the surge in morning foodservice visits to multiple factors. It found that a major driver is the return-to-office trend, with office attendance up by 20% in 2024 compared to the previous year. A recent KPMG study also predicts that most large offices will return to a five-day workweek within three years, further fuelling the morning demand for coffee and breakfast items.

Additionally, breakfast is often purchased out of necessity as many people eat during their commute to work. Morning footfall growth is particularly strong in urban centres, with London leading the trend at a 13% increase, well above the national average of 8%.

"Morning traffic is clearly driven by increased office attendance, particularly in central business districts," Maria Vanifatova, CEO of Meaningful Vision, said. "In London, for example, morning traffic jumped 13%, significantly higher than the 8% national average. Central London saw even more pronounced growth."

To capture this growing morning traffic, leading foodservice brands have intensified their competitive efforts with aggressive pricing and promotional deals. Chains like McDonald’s and Greggs are leveraging affordability to attract customers, offering some of the most competitively priced breakfast deals at £2.79 and £2.85, respectively.

Popeyes has taken this strategy further, introducing a £1.99 breakfast deal to entice early-morning consumers.

McDonald’s remains the leader in the UK breakfast market, followed by Greggs and Pret A Manger. Both Greggs and Pret have expanded their store presence, contributing to their increased market share. Pret A Manger's positions and performance are especially strong in London. Meanwhile, Wetherspoon, the only pub amongst the top breakfast chains, has also made notable gains in 2024.

Meanwhile, the opposite trend is seen in evening dining.

Dinner is a discretionary meal that consumers are more likely to prepare at home, particularly in the face of economic pressures. Evening traffic declined by 12%, reinforcing the notion that consumers are prioritising budget-friendly meals like breakfast while cutting back on dining out later in the day.