Chart of the Week: Food price surge shows disparity across categories

Drink price surge was more restrained than food cost escalation.

The recent market's price surge in June reveals an intriguing pattern of disparity across categories. Meaningful Vision's analysis sheds light on this dynamic, showcasing that whilst food costs escalated by 19%, the increase in drink prices was relatively restrained at 12%.

Maria Vanifatova, CEO of Meaningful Vision Ltd, points out the rationale behind this asymmetry. She explains that economic challenges elevate the likelihood of consumers forgoing drinks, particularly those who prioritize eating over socializing.

Additionally, the convenience of purchasing drinks from supermarkets further curtails price growth in this category.

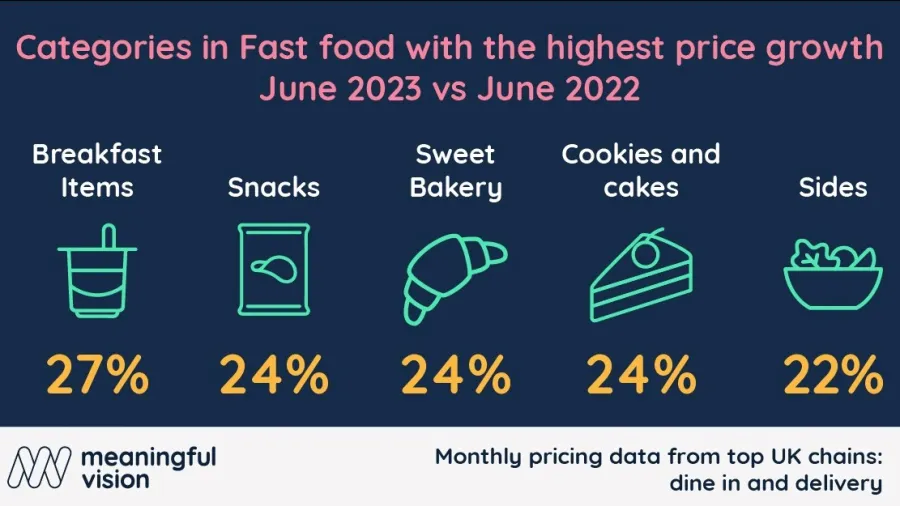

"Amidst these fluctuations, the most substantial price hikes materialized within the realm of relatively inexpensive and non-essential food categories: extras, breakfast items, sides, and snacks. In contrast, staple categories like burgers, sandwiches, various meal combos, and pizza experienced milder price increments," Maria said.

Maria adds that the restrained price growth for main meal items can be attributed to strategic promotional activities.

"These promotions, often linked to core menu items, serve to cushion the impact of rising costs whilst extending enticing value to customers, with discounts of up to 50% on select items."

In this intricate dance of price dynamics, Fast Food chains demonstrate a nuanced approach, holding back the growth in prices for mainstay items while adapting to the economic climate with measured increases in other categories. This strategic interplay enables them to strike a balance between customer preferences, profitability, and value-driven promotions.

Read the whole study here.