Chart of the Week: Pizza delivery disparity

Pizzerias exhibit the most uneven regional distribution.

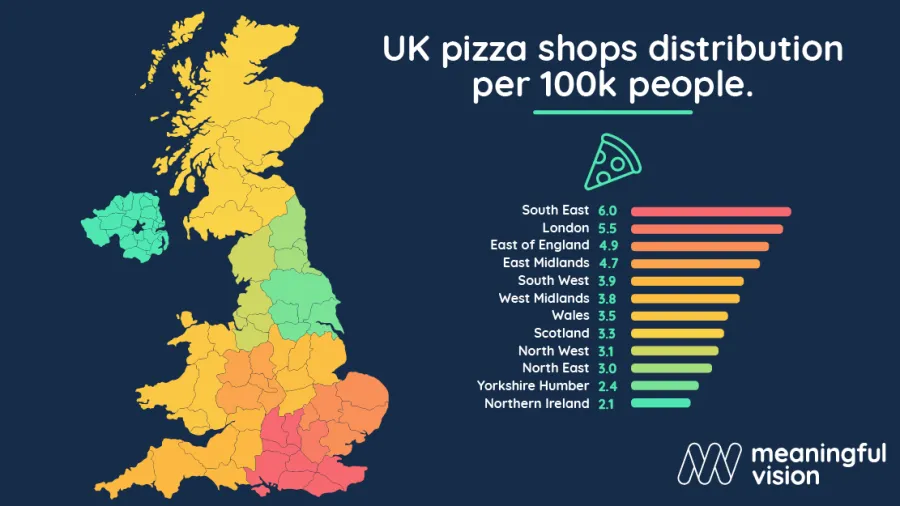

This chart from Meaningful Vision shows the regional distribution of pizzerias in the UK.

Meaningful Vision analyses it's up to the minute data pertaining to the United Kingdom's 70 largest fast-food chains. The most recent report covers various restaurant categories, including quick-service chicken and burger restaurants, bakeries and sandwich shops, coffee houses, Asian cuisine, and pizza delivery outlets.

Regional highlights

Amongst the wide variety of fast-food outlets in the UK, Pizzerias exhibit the most uneven regional distribution.

Unlike burger shops, with a difference of 1.5x between the highest and lowest density areas, examining the distribution of pizzerias, the disparity between the most and least densely populated areas is threefold: South East (6.0) vs. Northern Ireland (2.1).

Cities insights

Towns and cities with the highest number of pizza deliveries include Ashford (7.94), Milton Keynes (7.91), High Wycombe (7.49), Blackpool (7.45), and Aberdeen (7.15), all having 7 or more delivery pizza outlets per 100,000 people.

In contrast, Oldham (1.47), Barnsley (1.52) and Bradford (1.67) round out the list with a rate of around 1.5 outlets per 100,000, and a density of approximately 4.5 times lower than the leading towns and cities.

London's pizza scene

The distribution of chain pizzerias across London maintains a relatively uniform pattern. The difference between the most, and least densely populated area is 1.5, in stark contrast with coffee shops where the difference is 11.

The most well represented area is Central London (7.2), followed by South West (5.8), and South East (5.4). West London (5.1) reports slightly higher per capita restaurant numbers than North West (4.3) and East London (4.2).

According to Maria Vanifatova, CEO of Meaningful, there are several factors that influence the number of pizza deliveries.

“Regions with higher population densities and larger share of urban areas tend to have more pizza delivery services because they have a larger customer base. The relative economic prosperity of a region has a major influence on the frequency of pizza deliveries; in those regions with higher disposable incomes, people are more likely to order pizza. When making decisions about whether to open a new pizzeria or not, it's important to be aware of demographic and economic factors. However, it's equally important to understand the existing competitive environment – who the players are in the market and how their businesses are performing. We regularly monitor this information, and as we keep abreast of the constantly changing fast-food industry landscape, we are dedicated to providing data to the professional community so that you can grasp the market's trends and position yourself to make well-informed decisions," Vanifatova said.