Rate of food price increases slows more rapidly for main meals

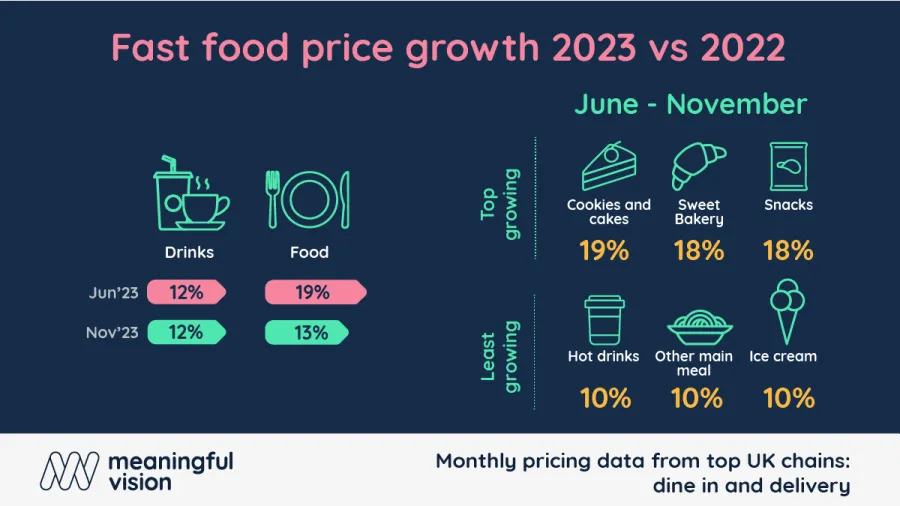

The slowdown in price growth was more visible for food items vs beverages.

Meaningful Vision’s reporting based on the Top 100 chains in the UK reveals price increases differ markedly across various segments: a slowdown in price growth was more visible for food items vs beverages, and for higher price brackets vs lower price points.

A closer look at individual menu categories reveals that price movements across the product ranges offered are not uniform.

Price increases amongst food items showed a greater slowdown than those for beverages in the last six months. Non-alcoholic drinks saw a 12% increase in prices, continuing the relatively steady month-on-month rate seen in the latter half of 2023, whereas food prices increased by 13% in November, a significant reduction from the high of 19% seen earlier in the period under review.

Meaningful Vision’s data analysis of individual menu categories reveals that, on average, price increases for main meals were lower than for snacks during the 2nd half of the year. Additionally, the rate of price increases for these products has also slowed more rapidly.

Price increases applicable to main meal categories like burgers, sandwiches, pizza, and meal deals have slowed significantly over the 6 months under review.

By contrast, snack categories such as cookies, cakes, snacks, and sweet bakery items all experienced continued price increases in November. Hot drinks, ice cream, soup, and salad prices showed the highest price growth during the 2nd half of 2023, whilst burgers, sandwiches, meal/combo offers, and pizza demonstrated the lowest growth rates.

Read the full story here.