Shift in fast food menus sees focus on £5-£10 offerings

25% of menu items are in this bracket but the landscape is slowly shifting.

Meaningful Vision’s research identifies some interesting trends emerging in the past year concerning the assortment size and structure of the UK’s typical fast-food menu.

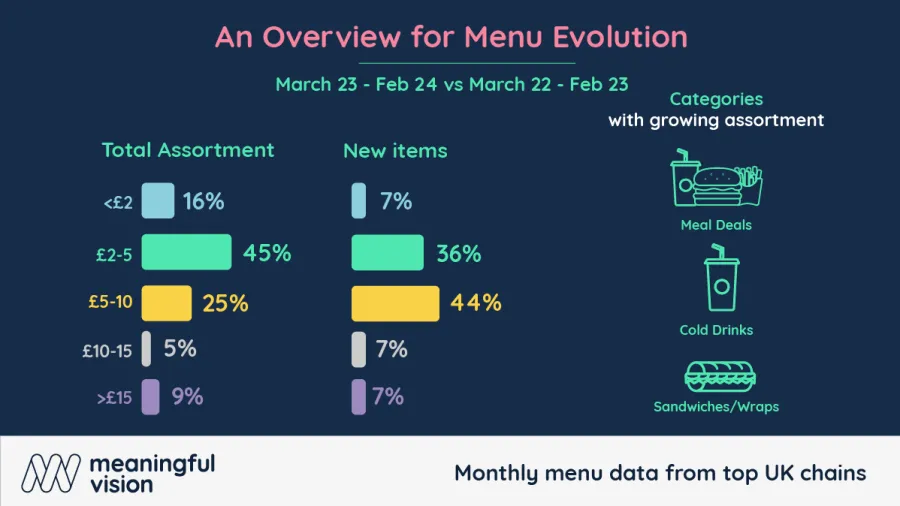

Whilst the distribution across price brackets of the average menu assortment remained largely unchanged throughout the year, with 45% of items offered in the £2- £5 range and 25% in the £5- £10 bracket, the landscape is slowly shifting.

The majority of new product launches are concentrated in the higher price range, reflecting concerns over price inflation which, despite a significant decrease from 17% in mid-2023 to 10% in February 2024, remains a focus for restaurants and their customers. Notably, only 36% of new items fell into the £2-£5 interval, whilst 44% were in the £5-£10 bracket.

The introduction of higher-priced offerings is balanced by a rise in the variety of meal deals available, which emerge as the predominant category amongst new products, closely followed by beverages.

Beverages, especially cold drinks and coffee offerings, i.e. frappes and iced coffees, are regaining prominence on fast-food menus after experiencing a 2% decrease in the previous year. The resurgence in beverages has led to a 1.4% increase in their share of the menu in 2024.

Meal deals have become the leading category among new products. As they tend to be pricier, their growing presence in menus contributes to the expansion of the mid to higher-priced segments.

“Meal deals have emerged as the dominant category, accompanied by a resurgence in beverages, sandwiches, and wraps. This trend reflects the industry's resilience in adapting to evolving consumer preferences and economic challenges," Maria Vanifatova, CEO of Meaningful Vision, said.

Read the full story here.