Consumer confidence remains stable, benefiting from return to sense of normality: study

IGD says there are some key opportunities for retailers and suppliers to target new at home occasions.

Confidence amongst food and grocery shoppers remained stable in August, slightly increasing due to support by the summer holidays and the Eat Out to Help Out Government scheme, with shoppers also benefiting from a general return to a sense of normality.

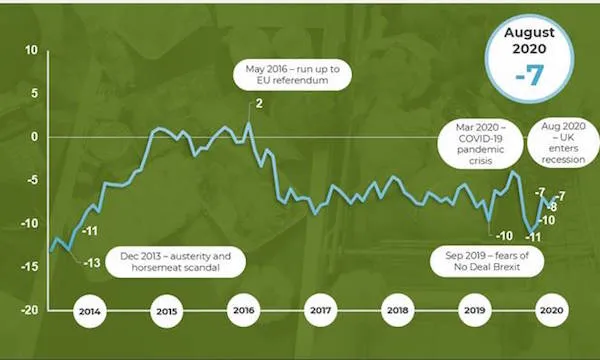

This is according to IGD’s latest Shopper Confidence Index, which revealed that shopper confidence remained relatively low at -7 in August, very slightly up on the previous month (-8 in July).

Confidence temporarily increased to -5 over the Bank Holiday weekend, up from -9 at the start of the month, before levelling off by the end of August.

Other Index highlights include 30% of shoppers expecting to be worse off financially in the year ahead, down from 34% last month and 50% in April, and 79% of shoppers expecting food prices to increase in the year ahead, down from 83% last month.

Confidence has increased this month among 35-44s, with IGD observing an increase in London for the third month running and in the South for the fourth month running.

As the UK officially entered recession this month, the insights agency says confidence remains subdued among lower income groups. Younger shoppers, notably, are less financially confident this month, with 24% of 18-24s expecting to be worse off in the year ahead (vs. 20% in July), and 33% of 25-34s expecting to be worse off (vs. 24% in July).

“The Bank Holiday, Eat Out to Help Out scheme and holidays have helped support shopper confidence over the last month. As we enter a period of events, with Halloween, Bonfire Night and Christmas on the horizon, we would hope for a similar effect over the coming months,” IGD director of global insight Simon Wainwright said.

“Overall shopper confidence is likely to remain fragile as unemployment levels rise and shoppers contend with the impact of an economic downturn in 2020. This will likely see an increased focus in savvy shopping behaviours from the shopper groups most affected, which businesses should consider for their 2021 planning.”

With many shoppers changing their behaviours and trying new things, Wainwright added there are some key opportunities for retailers and suppliers to target new at home occasions, such as celebrations and evening meals.