Popeyes turns to tech to hit £200m sales

The US-based fried chicken chain is looking for ways to engage with customers digitally.

Popeyes UK, which holds the master franchise for the Popeyes Louisiana Kitchen brand in the UK, is banking on a tech-enabled restaurant format as it tries to boost sales by a third to $252m (£200m) this year amidst declining business and consumer confidence in the UK.

Leading the charge will be the US-based fried chicken chain’s artificial intelligence (AI)-powered voice drive-thrus, which has been well received, according to its CEO.

“Our AI drive-thru pilot showed promising results with 97% order accuracy, and we had no complaints,” Tom Crowley, CEO of Popeyes UK, told QSR Media. “This allows our staff to concentrate on other operational areas where their input adds more value.”

Launched in March last year at Popeyes Northampton branch, the voice-ordering drive-thru is powered by a “conversational AI” that gets customer orders naturally and conversationally.

Dubbed “Al” — after Popeyes founder Al Copeland — the AI agent can handle different accents of UK consumers, which was a challenge for McDonald’s before it shut down its testing in June last year.

It also provides a digital display so guests can confirm their orders.

Aside from opening more AI-powered drive-thrus, Popeyes is also looking for ways to engage with customers digitally by expanding its kiosk restaurants, which complement the launch of its app last year.

“Our app already has more than 200,000 downloads, demonstrating our customers’ appetite to engage digitally with our brand,” Crowley said in an emailed reply to questions.

Popeyes ended 2024 with 65 restaurants and plans to add at least 45 more this year. To do this, the company expects to open 2,500 jobs.

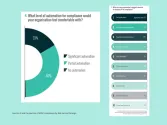

This is despite six in 10 hospitality leaders saying they plan to reduce staff this year, according to a Nielsen Consumer LLC report released in February.

Optimism has slipped despite solid trading for many hospitality groups over Christmas, stability in venue numbers, and easing inflation in some areas. More than four-fifths of leaders said their fourth-quarter trading was either ahead (43%) or level (40%) year on year. Only 31% said they increased their profits, whilst 29% said the opposite.

“Part of Popeyes’ customer unique selling proposition is hospitality,” Crowley said. “It’s how we set ourselves apart, and in order to ensure we are delivering for customers, we need our colleagues to feel happy, motivated and engaged with our business.”

They recently ran their first internal employee engagement survey, where the company scored 78%, significantly higher than the industry average, he added.

Crowley said operational scale and robust sales would help the brand deal with cost pressures facing the fast-food industry. “Our operational model, combined with strong sales, places us in a good position to manage rising costs.”

He said AI would play a crucial role in helping quick-service restaurants (QSR) differentiate themselves as the UK QSR sector becomes more competitive.

“AI will no doubt be an opportunity over the coming years for our sector as operators look across their businesses at how to harness its abilities in the right way,” he said. “That said, like most hospitality businesses, people will remain a central part of our operations to ensure we continue to provide high-quality customer service.”

“However, coupled with high-quality care in our food preparation and service, AI can be leveraged as a tool for success for Popeyes,” Crowley said.