Regional disparities define the UK’s fast food industry in 2024

A new report reveals how some areas are thriving whilst others face significant challenges.

Stark regional disparities emerging in 2024 reveal how the make-up of the fast-food landscape in the UK is far from uniform, according to the Consumer Footfall Traffic report by Meaningful Vision.

The data, gathered from over 120 fast-food restaurants across the country in the first half of the year, shows that some areas are thriving, whilst others face significant challenges.

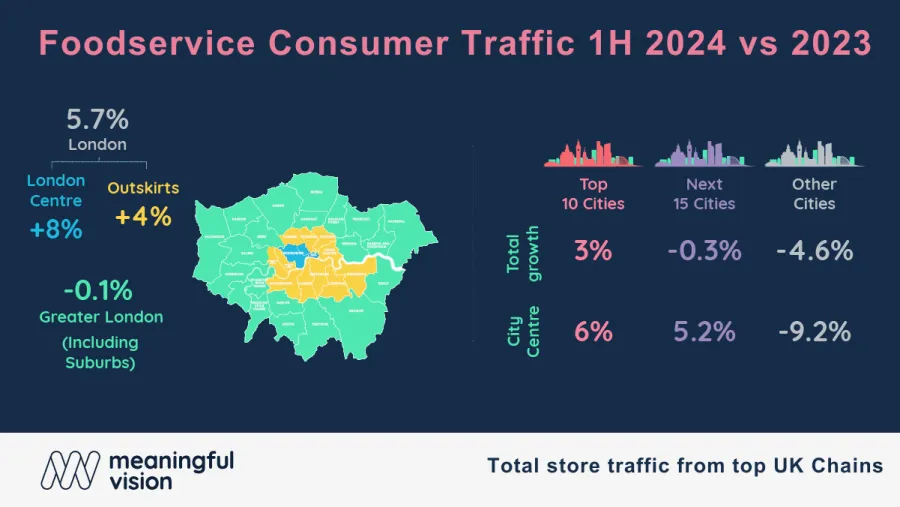

The capital city continues to dominate the fast-food scene, recording a substantial 5.7% increase in customer traffic. This impressive growth is fuelled by a combination of factors including a young and affluent population, a thriving job market, and a diverse cultural mix. London's central business district has been particularly buoyant, with an 8% surge in footfall, driven by office workers and tourists.

However, the outer boroughs report more modest growth, indicating a less concentrated pattern of consumption in comparison with central areas.

Uneven distribution beyond the capital

Whilst London shines, the rest of the UK presents a more complex picture. The 10 most populous cities outside London, including. Birmingham, Liverpool, Nottingham, Sheffield, and Bristol, managed a respectable 3% growth, benefiting from a mix of factors including large student populations, a high concentration of industry, and as regional capitals, a large civic and administrative workforce. The next tier of 15 cities, including Leicester, Edinburgh, Leeds, and Cardiff, saw little change, suggesting a stagnant, though stable market.

However, Meaningful Vision said the real story lies in smaller cities, which experienced a rather worrying 4.6% decline in fast-food traffic. This downturn is likely linked to a combination of economic challenges including rising unemployment and falling incomes. With household budgets stretched consumers may be opting for cheaper home-cooked meals or seeking ‘value for money alternatives.

Suburban struggle

The data also highlights a growing divide between city centres and suburban areas.

Whilst central locations across the UK have seen a healthy 3.6% increase in fast-food traffic, the suburbs have lagged with a 2.3% decline. This trend is particularly pronounced in London, where the city centre has outperformed the outer boroughs.

Bakery and sandwich sector an exception

One notable exception to this trend is the bakery and sandwich sector. Unlike fast food, this segment has experienced growth across different regions, including suburban areas. Chains like Greggs, Pret a Manger, and Gail's have been instrumental in driving this expansion.

“The UK fast-food industry is undergoing a period of significant change, with regional disparities becoming increasingly pronounced. While London continues to thrive, other parts of the country are facing challenges. As consumer behaviour evolves in response to economic pressures, operators will need to adapt their strategies to succeed in this complex and dynamic market,” Maria Vanifatova, CEO of Meaningful Vision said.