Consumer footfall traffic in foodservice slows down to -1.7% in Q3

Where are the remaining growth opportunities?

Meaningful Vision's Competitive Intelligence System reveals key trends in consumer traffic on the market for the top 100 chains, including fast food outlets, coffee shops, casual dining, and pubs. There has been a slowdown in the number of consumers from a positive 2.3% in Q1 to a negative -1.7% in Q3. Overall market growth recorded 0.2% in January-September 2023 compared to the year before, but like-for-like traffic declined by 1%.

According to Meaningful Vision's estimates, the average check increased by 6-8%. This is much lower than the price growth for individual menu items which surged by 17% in 2023. Consumers moved to seek savings in response to economic pressures, taking up the Combo Meal Deals and discounts on offer in greater numbers, decreasing the size of their order, and skipping less essential items like drinks, snacks or sides, comments Maria Vanifatova, CEO of Meaningful Vision.

MORE LIKE THIS: Which LTO category has the highest proportion in fast-food menus?

Growth of revenue as reported by trusted industry sources could potentially be misleading since a notable proportion of market growth may be attributed to inflation. At the same time, consumer traffic is the most accurate measure of a brand's performance in a volatile, high-inflation environment.

Where are the growth areas in the market today?

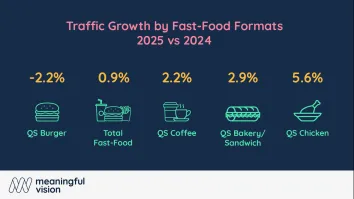

- Fast food — Fast food chains, being much more affordable, demonstrated better performance in January to September 2023 with an increase of 1.1%, whilst traffic to Restaurants & Pubs declined by almost 5%.

- Bakeries, Sandwich shops and Coffee shops — Despite challenges, growth opportunities persist, especially in key segments. Bakeries and sandwich shops lead with a 7% growth rate, followed by coffee shops with a 1% increase in the first nine months of 2023. Rapid growth areas for bakeries and sandwich shops include Yorkshire, the South-East, and London, which tops the list with an impressive 15% growth in total traffic.

- Morning and Daytime — QSR categories show the highest footfall traffic growth during morning and daytime hours, and bakery, sandwich, and coffee shops are benefiting the most from this trend. For instance, 32% of coffee shop visits occur in the morning. Daily visits across the food service sector are rising by 4%, whilst evening traffic is declining for almost all segments.

- Big cities and city centres — Office attendance patterns are evolving, with UK workers now spending 20% more time in the office according to Advanced Workplace Associates compared to a year ago. This shift contributes to traffic growth in QSR places located in big cities and especially in their centres, i.e. in the areas of the highest business activity. Fast food traffic growth in the top 25 cities during the first 9 months hovered at around 5%, a number five times higher than the market average. In city centres, the growth was even higher.

The disparity between various city and urban retail environments, shaped by elements such as competitor penetration and pricing policies, means one model cannot necessarily be applied across all locations. A detailed examination and thorough understanding of local market dynamics is therefore a key part of any growth strategy.

Maria Vanifatova, Meaningful Vision's CEO, highlights the importance of generating customer traffic for authentic growth: Analyzing traffic data enables a clear understanding of food service chain dynamics, devoid of inflationary influence. Meaningful Vision's Competitive Intelligence system allows you to benchmark your performance against competitors in each location and identify the most promising growth opportunities.