Cost pressures surge as foodservice inflation hits 6% in early 2025

Smaller restaurants operating on tight margins will struggle to absorb the costs.

Following a period of relative stability in 2024, entering 2025, inflationary pressures in the UK’s economy have resurfaced, Meaningful Vision’s recent Price Intelligence survey revealed.

The survey provides granular data on inflation in the UK’s foodservice sector, the real-time impact on prices, and the strategies operators are employing to counter adverse effects of inflation.

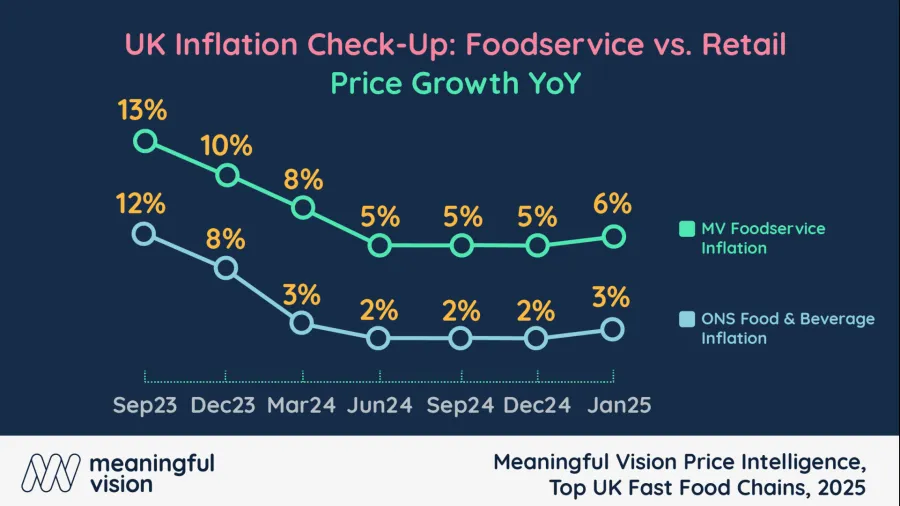

Year-on-year price growth, as measured by Meaningful Vision’s Foodservice Inflation metric and the Office for National Statistics’ Food & Beverage Inflation numbers, showed foodservice inflation experienced a cooling-off from highs of 13% in late 2023, settling to a more manageable 5% in 2024. This stabilisation likely offered much-needed respite from rising prices for both operators and consumers.

However, January 2025 marked a turning point as foodservice inflation resumed its climb, reaching 6%, the highest point since early 2024. This return to an ascending trajectory signifies a renewed wave of inflationary pressure hitting the sector.

By comparison, the ONS Food & Beverage Inflation rate showed a less dramatic increase, moving from 2% at the end of 2024 to 3% in January 2025, indicating the resurgence is currently more pronounced within foodservice.

The revival of an upward trend, as observed in foodservice inflation, is driven by several factors. Largely as result of new legislation, labor costs have escalated with estimates suggesting potential increases of up to 10%, placing significant financial strain on businesses. Additionally, rising ingredient costs, particularly for commodities like beef and coffee, are further contributing to the pressure on menu prices.

Meaningful Vision said restaurants, especially independent and smaller businesses operating on tight margins, will struggle to absorb these increased costs.

Passing the expense onto consumers risks dampening demand, particularly in a climate where household budgets are already stretched. The traditionally resilient fast-food segment has witnessed stagnating traffic growth, suggesting price sensitivity among consumers. Meaningful Vision CEO Maria Vanifatova anticipates dine-out prices are likely to rise faster in the coming year, potentially making it a less appealing option for many.

“Our data illuminates the evolution of consumer spending patterns in the foodservice sector, and highlights the urgent need for businesses to adapt their strategies in response to dynamic inflationary pressures,” Vanifatova said.